louisiana inheritance tax return form

Get Access to the Largest Online Library of Legal Forms for Any State. Do not write in this block.

Free Last Will And Testament Templates A Will Pdf Word Eforms Free Fillable Forms Last Will And Testament Will And Testament Obituaries Template

Requirements for Filing Returns Inheritance taxAn inheritance tax return must be prepared and filed for each succession by or on behalf of all the heirs or legatees in every case where inher- itance tax is due or the value of the deceaseds estate is 15000 or more LSA-RS.

. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. Estate transfer taxAn estate transfer tax return must be prepared and filed for each. State of Louisiana Department of Revenue P.

That is becasue an inheritance tax is a tax on the person who inherits the property not the estate itself. Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Schedule III Determination of Louisiana Inheritance Tax Name address and Social Security Number of heirs or legatees Schedule I Recapitulation of Detailed Descriptive List or Inventory R-3318 302. This is what I call the hidden estate tax.

Form 1029 sales tax return. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Underpayment of Individual Income Tax Penalty Computation- Non-Resident and Part-Year Resident.

Federal Estate Tax. This affidavit must be notarized. The inheritance could be money or property.

11012009 - present. The estate would then be given a federal tax credit for the amount of state estate taxes that were paid. RS 2425 - Inheritance tax return.

It operates almost like an. Its also a community property estate meaning it considers all the assets of a married couple jointly owned. The 5 million exemption will return for deaths occurring in 2026 and thereafter unless congress votes to extend the larger exemption.

In 2001 federal law changed and no longer permitted a federal tax credit for taxes paid to the state. For office use only. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

Third and even more importantly for Louisiana residents if your estate is not structured correctly the property in your estate may be subject to the INCOME tax by foreging the step up in basis at death. An inheritance tax is a tax imposed on someone who inherits money from a deceased person. Though Louisiana wont be charging you any estate tax the federal government may.

However according to the federal estate tax law there is no Louisiana inheritance tax. Ad Download Or Email Form LAT05 More Fillable Forms Register and Subscribe Now. If less than zero enter zero Schedule V Summary of Inheritance Tax Estate Transfer Tax and Interest Due 1 Inheritance tax due From Line 7 Schedule IV 2 Estate transfer tax From Line 8 Schedule IV 3 Interest due on inheritance and estate transfer taxes See instructions.

Underpayment of Individual Income Penalty Computation Resident Filers and Instructions. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The Act also provided that inheritance taxes due to the state for deaths occurring before July 1 2004 shall be considered due on January 1 2008 if no inheritance tax return was filed before January 1 2008 and the inheritance tax shall prescribe as provided by Louisiana Constitution Article 7 Section 16 in three years from December 31.

Louisiana does not impose. Payment of the tax due must accompany the return. The federal estate tax exemption was 1170 million in 2021 and increased to 1206 in 2022.

Find out when all state tax returns are due. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due. Repealed by Acts 2008 No.

Louisiana does not impose any state inheritance or estate taxes. This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011. An inheritance tax return shall be prepared and filed by or on behalf of the heirs and legatees in every case where inheritance tax is due or where the gross value of the deceaseds estate amounts to the sum of fifteen thousand dollars or more.

Louisiana inheritance tax laws suggest that for the property to be subject to inheritance tax its. 8 Louisiana estate transfer tax Subtract Line 7 from Line 3. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits.

Ad The Leading Online Publisher of National and State-specific Legal Documents. The portion of the state death tax credit allowable to Louisiana that. If you own property in Louisiana and pass it on as inheritance then the beneficiary will not be obligated to pay before transferring assets.

The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. Addresses for Mailing Returns. This affidavit must be notarized before it is submitted to the Secretary of Revenue.

If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. For office use only. Louisiana small succession affidavit form louisiana small estate affidavit pdf louisiana small succession louisiana small succession forms.

An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due.

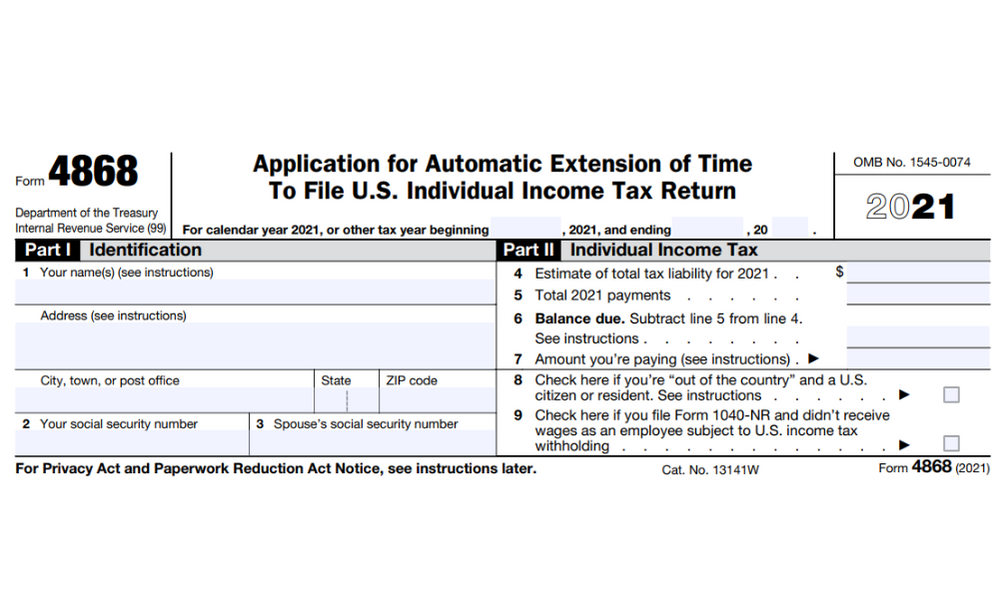

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Tax Form Templates 5 Free Examples Fill Customize Download

Are You Trying To Get On My Good Side Blue Dog Art Art Lessons Dog Art

What Is Schedule C Tax Form Form 1040

Free Form 1029 Sales Tax Return Free Legal Forms Laws Com

We Solve Tax Problems Debt Relief Programs Tax Debt Irs Taxes

Imagen Gratis En Pixabay Impuestos Impuesto Plastilina Business Tax Deductions Small Business Tax Deductions Tax Payment

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

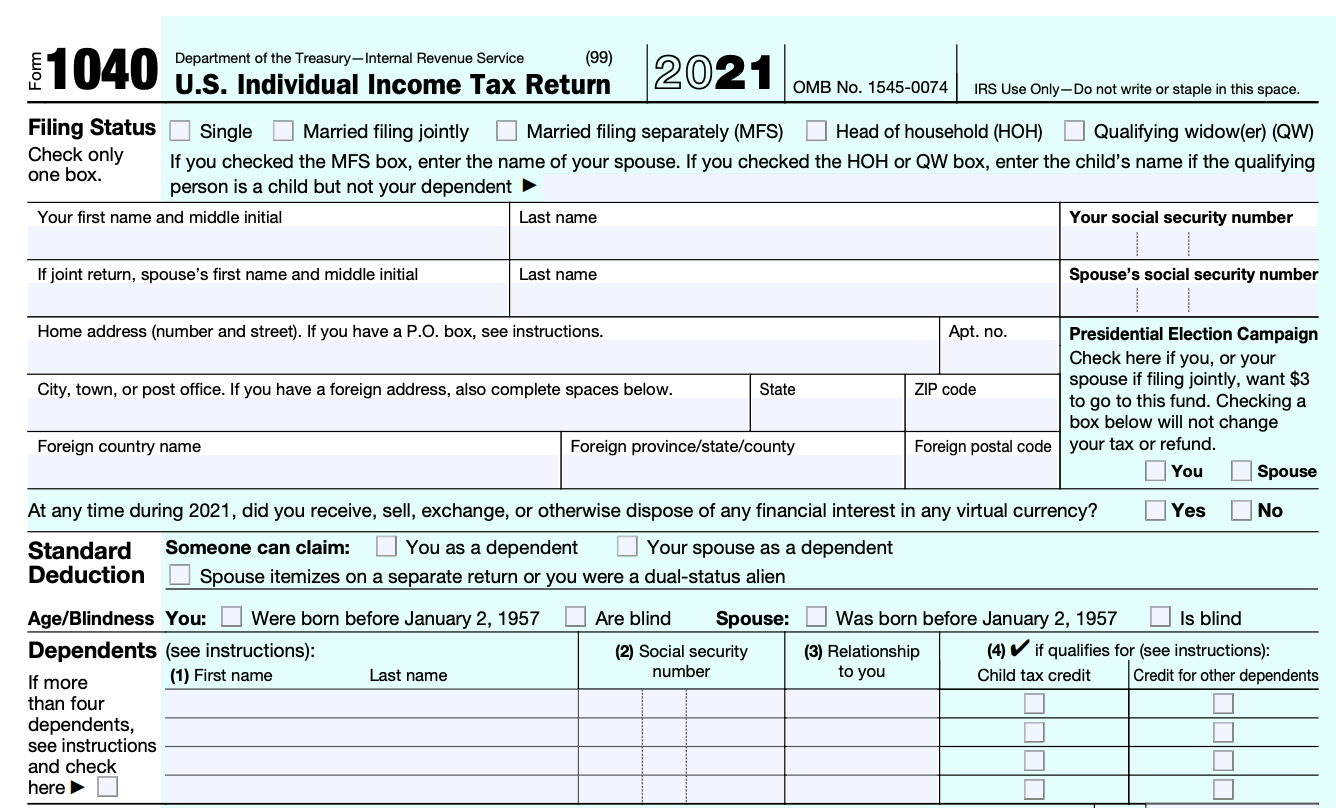

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

How To File Taxes For Free In 2022 Money

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

What Is Schedule C Tax Form Form 1040